Understanding your income and expenses is the first step to taking control of your finances. Your income includes your salary, wages, bonuses, and any other sources of money you receive regularly. It’s important to have a clear understanding of how much money you have coming in each month. On the other hand, your expenses include all the money you spend on bills, groceries, entertainment, and other necessities. It’s crucial to have a clear picture of where your money is going each month.

Once you have a clear understanding of your income and expenses, you can start to analyze your financial situation. This will help you identify any areas where you may be overspending or where you can potentially cut back. By understanding your income and expenses, you can make informed decisions about how to manage your money more effectively. This will also help you set realistic financial goals and create a budget that works for your specific situation.

Key Takeaways

- Understanding your income and expenses is the first step to taking control of your finances.

- Setting clear financial goals will help you stay focused and motivated to achieve them.

- Tracking your spending is essential to understand where your money is going and identify areas for improvement.

- Creating a realistic budget that aligns with your financial goals is crucial for managing your income and expenses effectively.

- Building an emergency fund will provide a safety net for unexpected expenses and help you avoid going into debt.

Setting Clear Financial Goals

Setting clear financial goals is essential for achieving financial success. Whether you want to save for a down payment on a house, pay off debt, or build a retirement fund, having clear goals will help you stay focused and motivated. When setting financial goals, it’s important to make them specific, measurable, achievable, relevant, and time-bound (SMART). This will help you create a roadmap for achieving your goals and keep you accountable.

By setting clear financial goals, you can prioritize your spending and make sure that your money is going towards the things that matter most to you. This will also help you stay on track and avoid unnecessary expenses that may derail your progress. Setting clear financial goals will give you a sense of purpose and direction when it comes to managing your money, and it will help you stay motivated to stick to your budget and make the necessary sacrifices to achieve your goals.

Tracking Your Spending

Tracking your spending is a crucial part of managing your finances effectively. By keeping track of where your money is going, you can identify any patterns or trends in your spending habits. This will help you see where you may be overspending and where you can potentially cut back. There are many tools and apps available that can help you track your spending, such as budgeting apps, expense trackers, or even just a simple spreadsheet.

By tracking your spending, you can also become more mindful of your purchases and make more informed decisions about where to allocate your money. This will help you avoid impulse purchases and unnecessary expenses that can quickly add up over time. By being aware of where your money is going, you can take control of your spending habits and make adjustments as needed to stay within your budget.

Creating a Realistic Budget

| Category | Metrics |

|---|---|

| Income | Total monthly income |

| Expenses | Total monthly expenses |

| Savings | Amount allocated for savings |

| Debts | Total outstanding debts |

| Emergency Fund | Amount set aside for emergencies |

Creating a realistic budget is essential for managing your finances effectively. A budget is a plan for how you will allocate your income towards various expenses and savings goals. When creating a budget, it’s important to be realistic about your income and expenses. This means taking into account all sources of income and accurately estimating your monthly expenses.

A realistic budget should also include room for unexpected expenses or emergencies, as well as savings for long-term goals such as retirement or buying a home. It’s important to prioritize your spending and make sure that your budget reflects your financial goals. By creating a realistic budget, you can take control of your finances and make sure that your money is working for you in the best way possible.

Building an Emergency Fund

Building an emergency fund is an important part of managing your finances responsibly. An emergency fund is a savings account specifically designated for unexpected expenses or emergencies, such as medical bills, car repairs, or job loss. Having an emergency fund in place can provide peace of mind and financial security in times of need.

When building an emergency fund, it’s important to start small and gradually increase the amount over time. Many financial experts recommend saving at least three to six months’ worth of living expenses in an emergency fund. This will provide a cushion in case of unexpected events and help you avoid going into debt to cover emergency expenses. By building an emergency fund, you can protect yourself from financial hardship and have the peace of mind knowing that you are prepared for whatever life may throw at you.

Sticking to Your Budget

Sticking to your budget is essential for achieving your financial goals and managing your money effectively. Once you have created a realistic budget, it’s important to stick to it as closely as possible. This means being mindful of your spending habits and making conscious decisions about where to allocate your money.

Sticking to your budget may require making sacrifices and prioritizing your spending, but it will ultimately help you stay on track towards achieving your financial goals. It’s important to regularly review your budget and make adjustments as needed to ensure that it continues to reflect your current financial situation. By sticking to your budget, you can take control of your finances and make sure that your money is going towards the things that matter most to you.

Adjusting Your Budget as Needed

Adjusting your budget as needed is an important part of managing your finances effectively. Life is unpredictable, and unexpected events or changes in circumstances may require you to make adjustments to your budget. This could include changes in income, unexpected expenses, or shifts in priorities.

By regularly reviewing and adjusting your budget, you can ensure that it continues to reflect your current financial situation and goals. This will help you stay on track towards achieving your financial objectives and make sure that your money is working for you in the best way possible. By being flexible with your budget and making adjustments as needed, you can take control of your finances and adapt to any changes that may come your way.

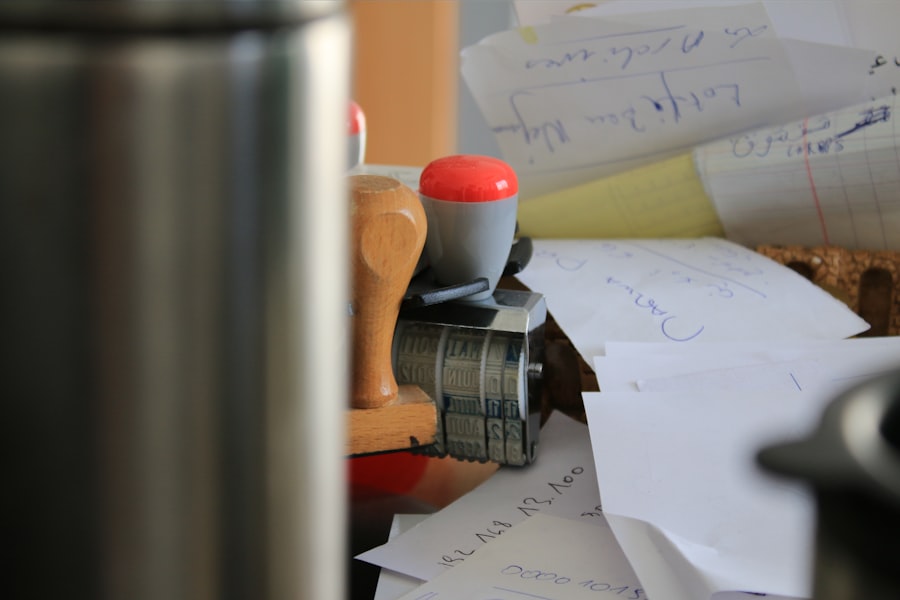

If you’re interested in learning more about the history and significance of approved stamps, check out this article on thecottonsmith.com. This website offers a detailed look at the use of approved stamps in various industries and provides insight into their importance in ensuring quality and compliance. It’s a great resource for anyone looking to understand the role of approved stamps in business and manufacturing.

FAQs

What is an approved stamp?

An approved stamp is a mark or seal that indicates that a document, plan, or product has been reviewed and meets the necessary requirements or standards.

Where is an approved stamp commonly used?

Approved stamps are commonly used in various industries such as construction, engineering, manufacturing, and government agencies to signify that a particular item has been approved for use.

Who can issue an approved stamp?

An approved stamp is typically issued by a qualified individual or authority who has the expertise and authority to review and approve the specific item in question.

What are the benefits of using an approved stamp?

Using an approved stamp provides assurance that the item has been thoroughly reviewed and meets the necessary standards, which can help prevent errors, ensure compliance, and maintain quality control.

Are there different types of approved stamps?

Yes, there are different types of approved stamps, including those for engineering drawings, building plans, quality control, and regulatory compliance. Each type of stamp may have specific requirements and criteria for approval.